Westmeath house prices up 12pc in twelve months – REA survey

The price of the average second-hand three-bed semi in County Westmeath has increased to €330,000, up 12pc from €295,000 in the last twelve months, according to a national survey by Real Estate Alliance.

Across the county this quarter, prices remained unchanged, and the average time taken to sell in the county currently sits at four weeks, the Q2 REA Average House Price Index shows.

“The market is looking strong, with shortage of supply pushing prices up,” said Donna Hynes of REA Hynes.

The survey shows that across the county, 85pc of purchasers were first-time buyers, while a total of 5pc of sales in the county this quarter were attributed to landlords leaving the market.

Additionally, agents across the county reported that the BER ratings of properties saw A-rated properties command 10pc price increases in comparison to comparable C-rated properties.

The REA Average House Price Index concentrates on the sale price of Ireland's typical stock home, the three-bed semi, giving an accurate picture of the second-hand property market in towns and cities countrywide.

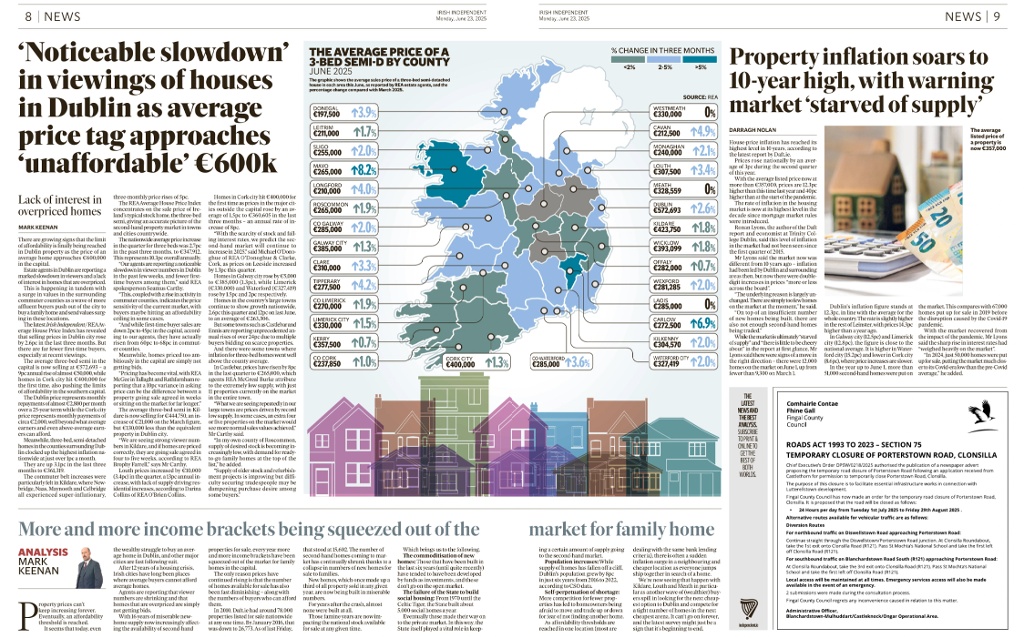

The actual selling price of a three-bed, semi-detached house across the country rose by 2.7pc in the past three months to €347,912, and 10.3pc overall annually.

While actual selling prices in Dublin city rose by 2.6pc in the last three months, REA agents have noticed fewer first-time buyers at recent viewings.

The average three-bed semi in the capital is now selling at €572,693 – a 9pc annual rise of almost €50,000.

The country’s biggest rises this quarter came in the commuter belt, as selling prices increased by 3.1pc to €361,319.

The commuter belt increases were particularly felt in Kildare, where Newbridge, Naas, Maynooth and Celbridge all experienced three-monthly price rises of 5pc.

Homes in Cork city hit €400,000 for the first time as prices in the major cities outside the capital rose by an average of 1.5pc to €360,605 in the last three months – an annual rate of increase of 8pc.

The REA survey found that properties with a BER rating of A commanded an average 16pc premium over C-rated stock.